BRIDGETON – Missouri Baptist Children’s Home Children and Family Ministries (MBCH-CFM) and The LIGHT House (LH), both affiliate ministries of MBCH are offering 70% Missouri state tax credits. These are Pregnancy Resource Center tax credits (PRC) and Maternity Home tax credits (MHC). This is a tax credit not a tax deduction. So, if you have a Missouri tax liability, you can make a gift to MBCH-CFM or The LIGHT House of $100 or more and get a 70% Missouri tax credit. For every tax credit gift of $100 to MBCH-CFM or The LIGHT House you will receive a $70 Missouri tax credit that goes directly to reducing your tax liability.

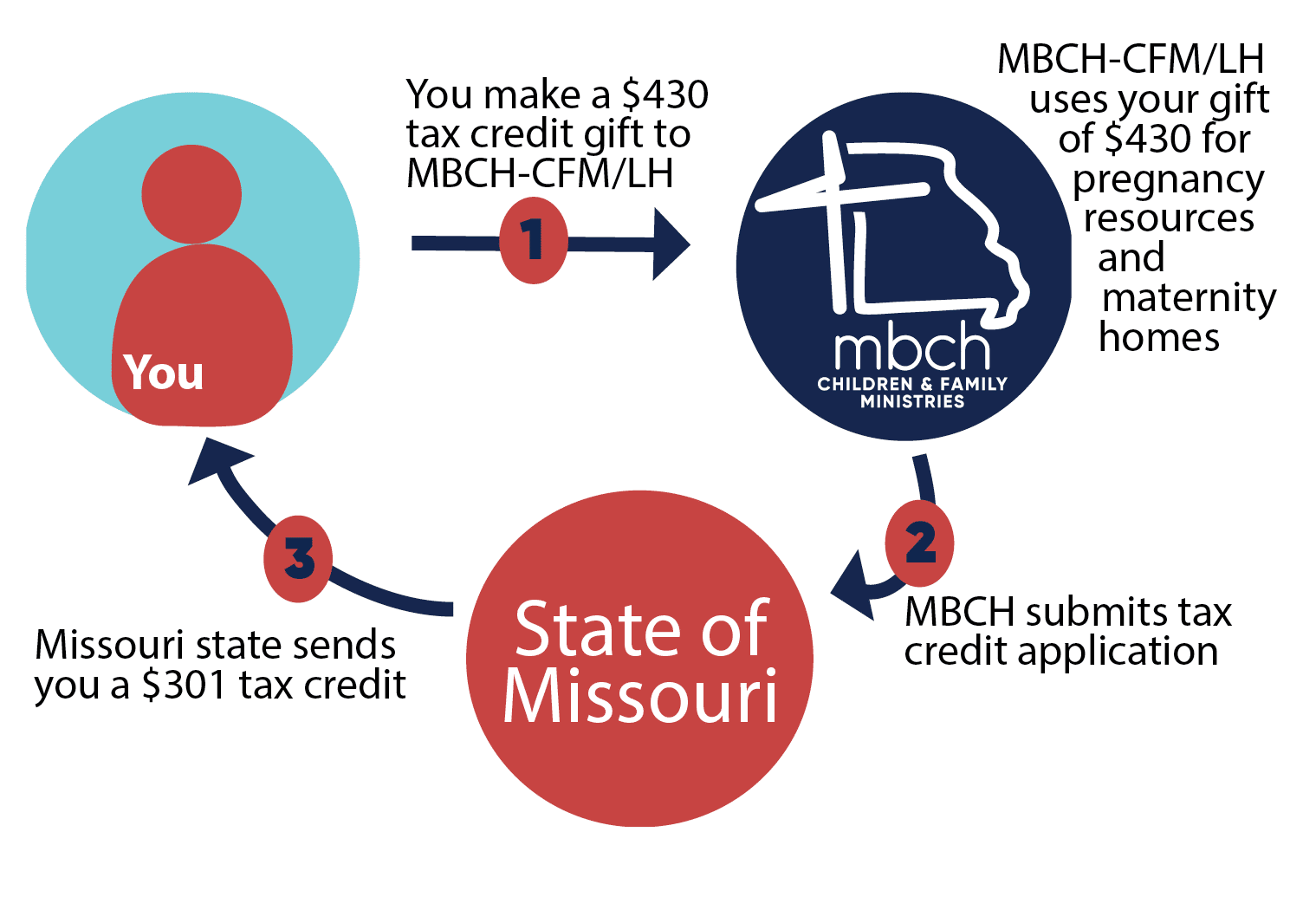

EXAMPLE:

If you know that you have a $300 tax liability, instead of paying the state of Missouri $300, you can choose to make a $430 gift to MBCH-CFM or The LIGHT House and receive a tax credit for $301 towards your Missouri tax liability. This means once your Missouri taxes are complete, your $430 gift will also provide a $301credit towards your expected Missouri tax liability for the following year!

TAX CREDIT VERSUS TAX DEDUCTION

A tax credit is not the same as a deduction. Deductions reduce your taxable income while tax credits directly reduce the amount of tax you owe. In fact, 70% of your eligible donation to MBCH (up to $50,000 in PRC and $50,000 in MHC per year) may qualify for a tax credit for your business or individual Missouri tax return.

For more information or to make a tax credit donation visit, mbch.org/tax-credit-giving/.

For more information about this, the affiliate ministries of Missouri Baptist Children’s Home or for general inquiries about our mission and ministry, call 1-800-264-6224 or visit our website at www.MBCH.org.